Sui (SUI) Holds Critical Support — Is It Time to Buy the Dip?

The cryptocurrency market remains under significant selling pressure, with major altcoins struggling after their late 2024 rallies. Ethereum has dropped from its December high of $4,000 to $1,900, dragging down the broader altcoin market. Sui (SUI) has been among the hardest-hit assets, suffering a 55% correction over the past 60 days, shaking investor confidence.

Key Support Levels in Focus

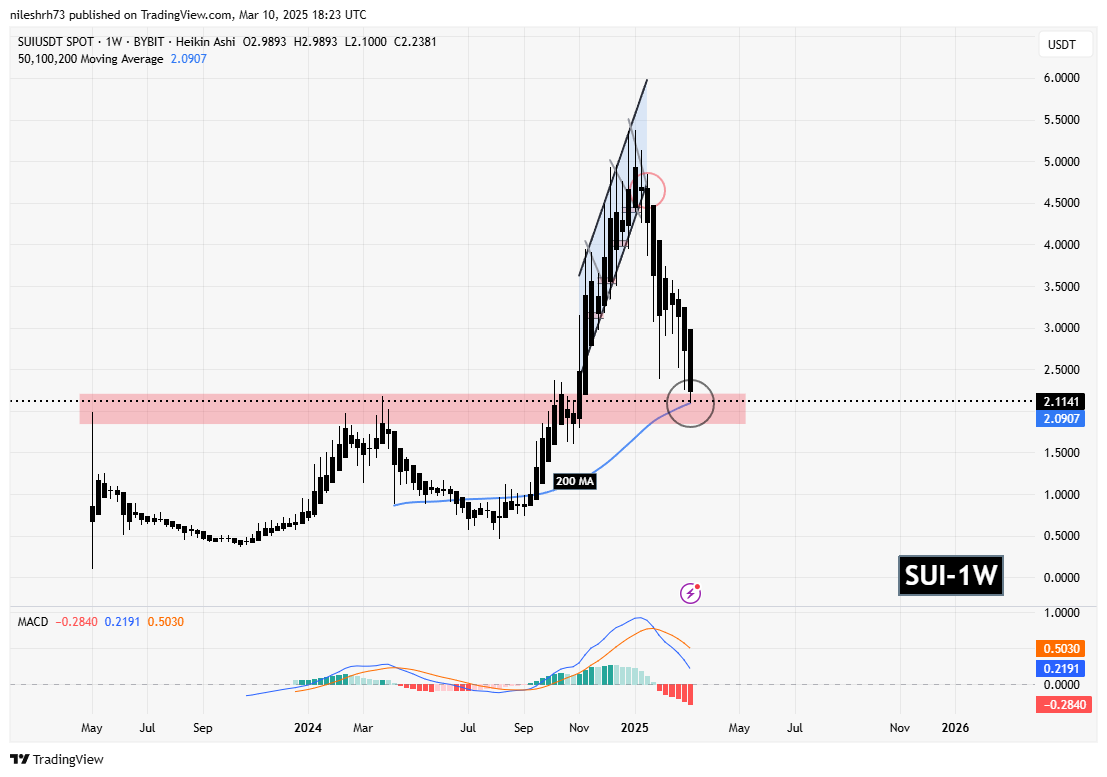

SUI’s decline follows its rejection from the ascending channel’s support trendline at $4,66, triggering a sharp sell-off. Now, the token has reached a crucial support zone that aligns with its 200-day moving average. This level previously acted as strong resistance before the breakout, making it a key area for potential price stabilization.

If SUI holds above this confluence of support, it could mark an attractive accumulation opportunity. However, traders should watch for confirmation signals such as rising volume, bullish candlestick patterns, or a shift in MACD momentum before taking long positions.

Will SUI Rebound or Drop Further?

If buying pressure emerges, SUI could recover toward the $2,50–$3,00 range in the short term. However, failure to maintain support may lead to further downside, with the next major level at $1,80. Risk management will be crucial as investors weigh whether SUI can stage a recovery from its current position.