Ethereum Struggles as Whale Activity Shows Mixed Signals

Ethereum recorded a massive 14.36% value decrease on Sunday and Bitcoin (BTC) lost 8% in value. Ethereum suffered much deeper loss in value starting December compared to Bitcoin which kept holding its support level. The difference between the two coins points out how Ethereum performs weakly against Bitcoin.

Ethereum”s development pace continues to rise during declining market prices. According to Analyst Brian in his Santiment Insights report Ethereum decreased its market capitalization but its development activity jumped by 13%.

During the last month developer participation climbed 1.9 percent with their total participation numbers. Several active developers maintain their focus on Ethereum despite the slow market performance.

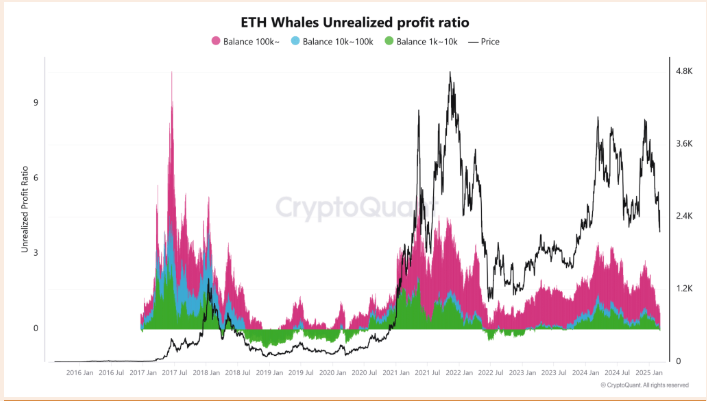

ETH Profit-Loss Ratios Mirror Bear Market

Major investors known as whales heavily affect the market when they buy or sell their assets. The analytical work displayed both large investors suffering losses and purchasing more Ethereum Tokens.

Results from CryptoQuant user Darkfrost show Ethereum whale buyers took similar profit-loss ratios in the last bear market period. Between March 4 and 6 Ethereum holders with 1,000 to 10,000 ETH lost 0.07% of their investment while persons with 10,000 to 100,000 ETH recorded a loss of 0.017%.

The negative profit levels indicate Whale investors do not plan to instantly sell their Ethereum supply to guarantee profits. Ethereum”s weak market position may cause significant investors to invest in alternate coins which will add more selling force to ETH.

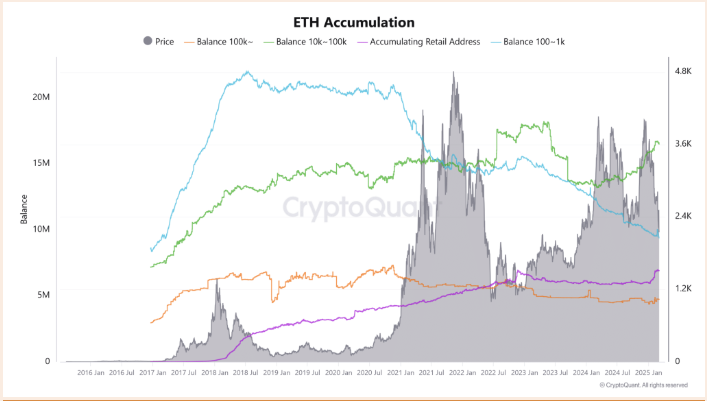

Research showed unique investment patterns between investor groups. Purchasing behavior for Ethereum has slowed down in wallet accounts that hold 100 to 1,000 ETH since the beginning of 2023.

The biggest ETH holders between 10,000 to 100,000 ETH strongly increased their investments starting from March 2018 into recent weeks. In February retail investors strongly added ETH to their portfolios yet their purchasing activities remained moderate after that. Since two years ago wallets above 100,000 ETH have shown a minor downward trend.

Despite investors feeling bearish the recent whale buying activity creates small signs of confidence. Despite current market issues the long-term development plan and strategic buying by investors creates a good basis for Ethereum”s future growth.