DeFi Struggles as Crypto Market Reacts to Trump’s Election

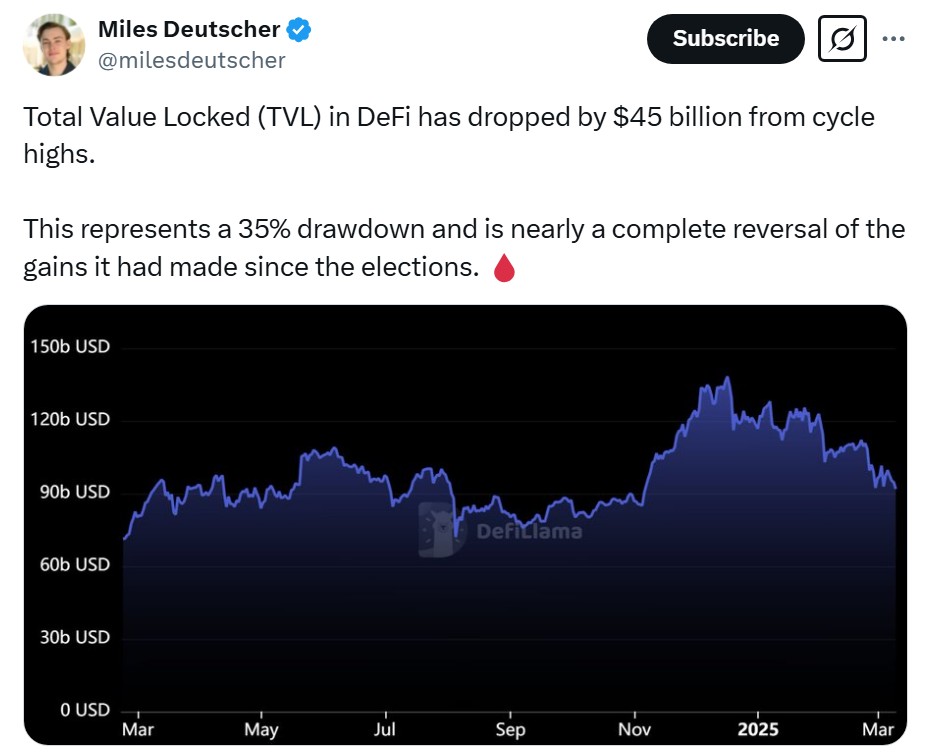

The decentralized finance (DeFi) total value locked dropped hard from its post-Trump election peak of $138 billion to $92.6 billion as of March 10. An analyst tracked DeFi TVL from $138 billion on Dec. 17 to $92.6 billion by March 10.

Both Solana and Ethereum face difficulties today despite industry attention focusing mostly on Solana because of falling memecoins interest. The market has since drifted lower than $4,787 set in the peak of November 2021 despite Bitcoin reaching $109,000 the day Donald Trump assumed office.

Ethereum TVL Drops $30.6B Amid DeFi Decline

The data from DefiLlama demonstrates that Ethereum”s total value locked dropped $30.6 billion since its highs in 2022 while the whole DeFi sector declined.

The market still falls while Bitcoin industry growth continues through Spot Exchange-Traded Funds and the United States” Bitcoin storage policies. Ethereum continues to grow positively but these advancements have not pushed it to reach higher prices.

Ethereum has been moving away from stored funds on exchanges in significant numbers during recent weeks. According to IntoTheBlock data ETH deposits ran beyond 800,000 coins from exchanges just after March 3 resulting in $1.8B of assets moving out in a single week.

Data from CoinGecko shows that Ether price fell 10% during this movement of assets from official exchanges. Ethereum holders usually move funds off exchanges when they plan to hold their investments long-term or place their assets into DeFi earning opportunities.

Pectra Update Promises Lower Fees and Better Pools

According to IntoTheBlock on their March 10 post on X, holders purchase Ether now because prices remain attractive despite market uncertainty.

Prior to March 3 Ethereum received daily investment deposits while investors quit selling according to Juan Pellicer research analyst at IntoTheBlock. The market saw people take their ETH from exchanges after its price dropped to $2,100 but they kept buying.

Moving toward rollup technology reduced network traffic and fees yet created separate pools of digital assets across the system. The upcoming Pectra software update will make Layer-2 systems more effective and linkable to solve present network performance problems.

Through its new system Pectra will provide lower fees and pool funds better between different networks. The update lets smart contract wallets work better between Ethereum and layer-2 systems which makes it easier to handle funds across different networks.

Even though the Pectra software launch met resistance at startup. On March 5 Sepolia testnet users experienced problems because deposit contract errors triggered wrong event data and caused influenced Geth nodes to mine empty blocks. The team led by Marius van der Wijden settled the issue but this episode reveals that software improvement requires more time and effort.

Ethereum needs to resolve its basic functionality problems to benefit from its institutional support in the future. The crypto market waits to see if President Trump will bring better regulation but continues in its current state of transition.