Bitcoin’s Fate Tied to Treasury Volatility as Dollar Plunges

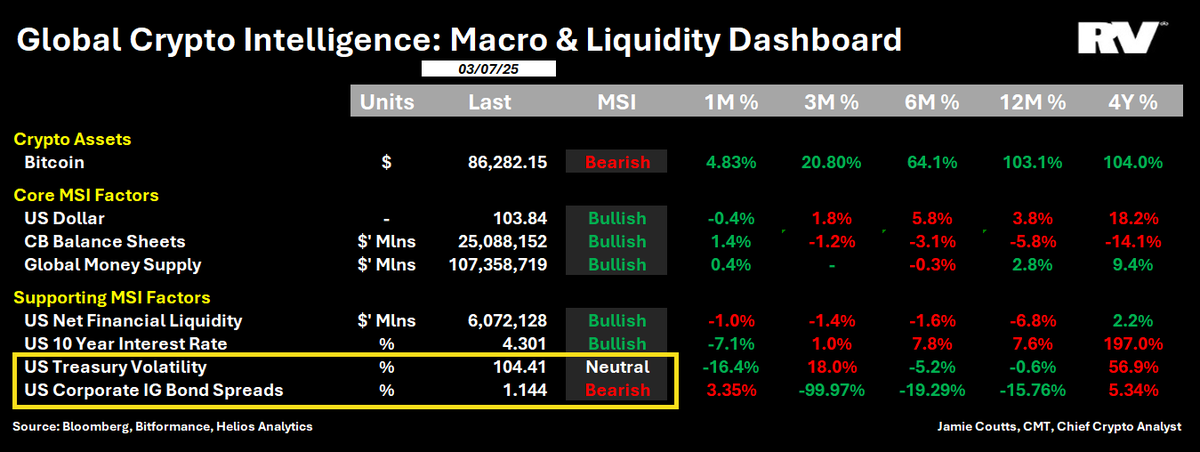

According to market analyst Jamie Coutts from RealVision, Bitcoin price trajectory gets more entwined with the US Treasury and with corporate bond spreads.

US dollar has just suffered its most massive one month fall that so far goes back a decade and usually in Bitcoin history this has been a historically bullish signal but doubts over the stability of the bond market could offset positive momentum in the blockchain’s valuation.

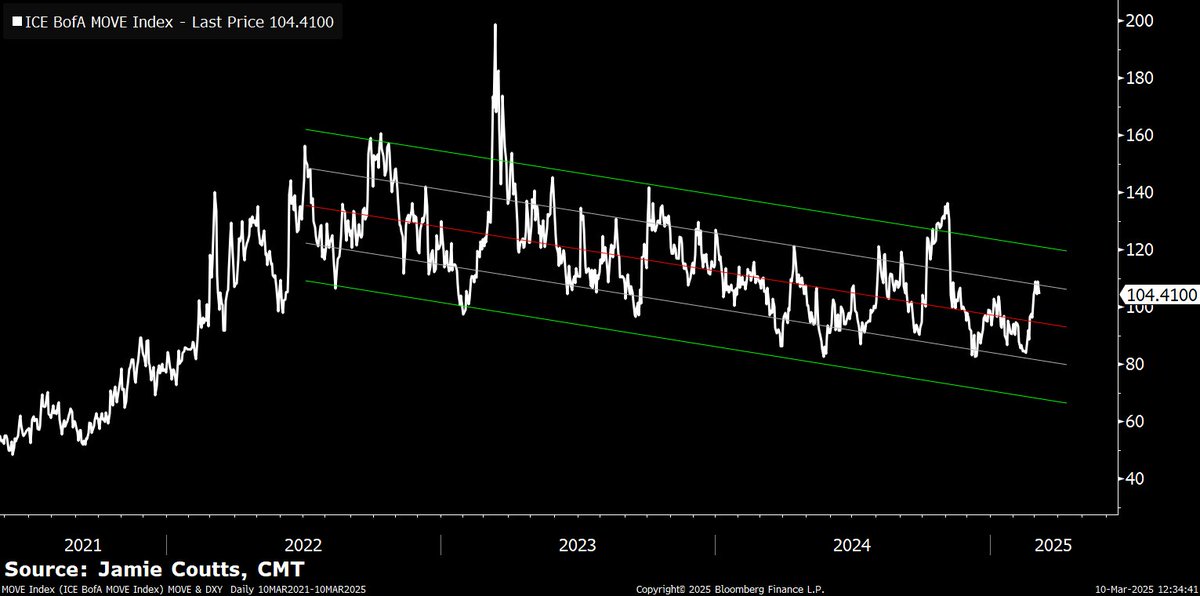

The MOVE Index, which measures the volatility of US Treasury bonds, is an important key metric as it affects Bitcoin’s market behavior. This is because US Treasuries are the fundament of global collateral markets and, therefore, keeping them stable is important for maintaining liquidity of the financial system.

Dollar’s Decline: A Bullish Signal for Bitcoin’s Future?

Coutts sees that should the MOVE Index go above the 110 threshold from its stable range since 2022 it could prompt central bank interventions, tightening liquidity conditions and what stances investor strategies. Widening of corporate bond spreads, or the risk appetite spreads in the credit market, is also another major factor at play.

If these spreads continue to increase, it will likely indicate investor growing uncertainty about corporate debt, a historical correlation of which tends to decline Bitcoin’s price. Such a trend may add more tailwinds for the cryptocurrency’s growth outlooks.

These risks, however, are slightly eased by the fact the US dollar has seen its biggest decline in 12 months. The current weakness of the dollar is going to precede future bitcoin bull runs, which actually bode well for the digital asset. This dynamic, Coutts notes, is precisely what is needed if the dollar continues to slide; it just so happens that bond market turbulence, meanwhile, is rising as a negative power.

According to Coutts, Bitcoin’s near term trajectory depends on how central banks react to a bond market crisis and changes in credit conditions. An extended bond volatility and credit market tension could potentially muddy the picture, but an extended dollar decline could fuel bullish sentiment.

However, Bitcoin continues on the line of financial market shifts and new liquidity dynamics, and investors will watch the macroeconomic indicators closely.