Bitcoin Market Shows Strength Amid Whale Accumulation

The Bitcoin (BTC) market shows positive upward potential when investors move $900 million out of their exchanges back to their wallets. The large exchange withdrawals show us investors are starting to feel better about BTC as prices remain below $100K.

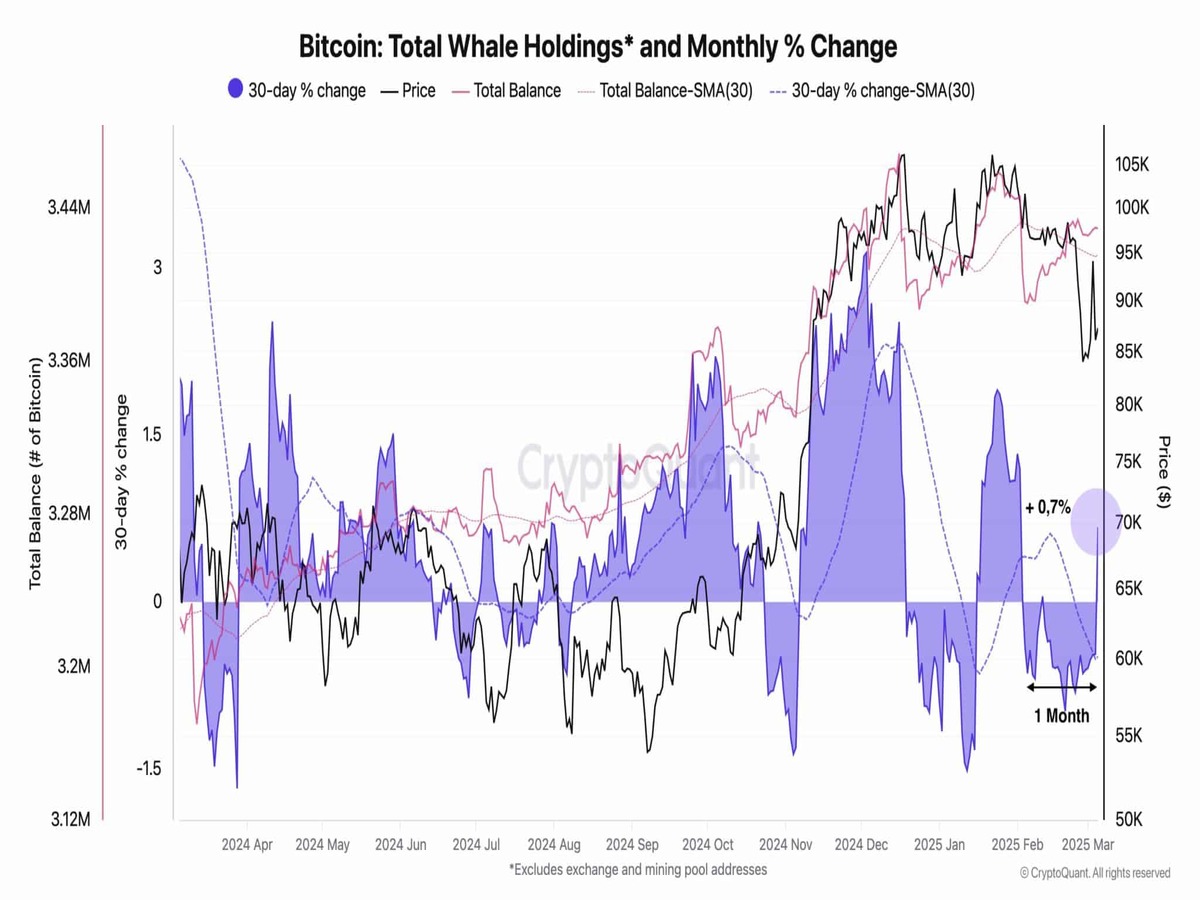

During the past month Bitcoin whales continuously sold their assets despite daily slumps in values. The long run of net selling by market whales generated worries about Bitcoin”s price direction. Recent research now reveals that the whale investors are resuming their purchase activity after having stopped buying previously.

Whale Buying Signals Potential Bitcoin Price Surge

Whale buying usually foretells a rising market value. Traders are adding BTC to their wallets while removing it from exchanges because they believe Bitcoin has stable bottom prices. Near its price support zone traders see BTC holding as safer than selling which adds more buying momentum to the market.

According to this expert traders have chosen to buy rather than sell because they have recognized a strong market safety baseline. The current buying behavior shows strong indications of a market that may rise in value.

However, the situation remains delicate. The BTC market may shift as whale investors continue to buy but will weaken if they switch back to selling mode. The following weeks will show if Bitcoin keeps building its upward trend or if market conditions derail it.

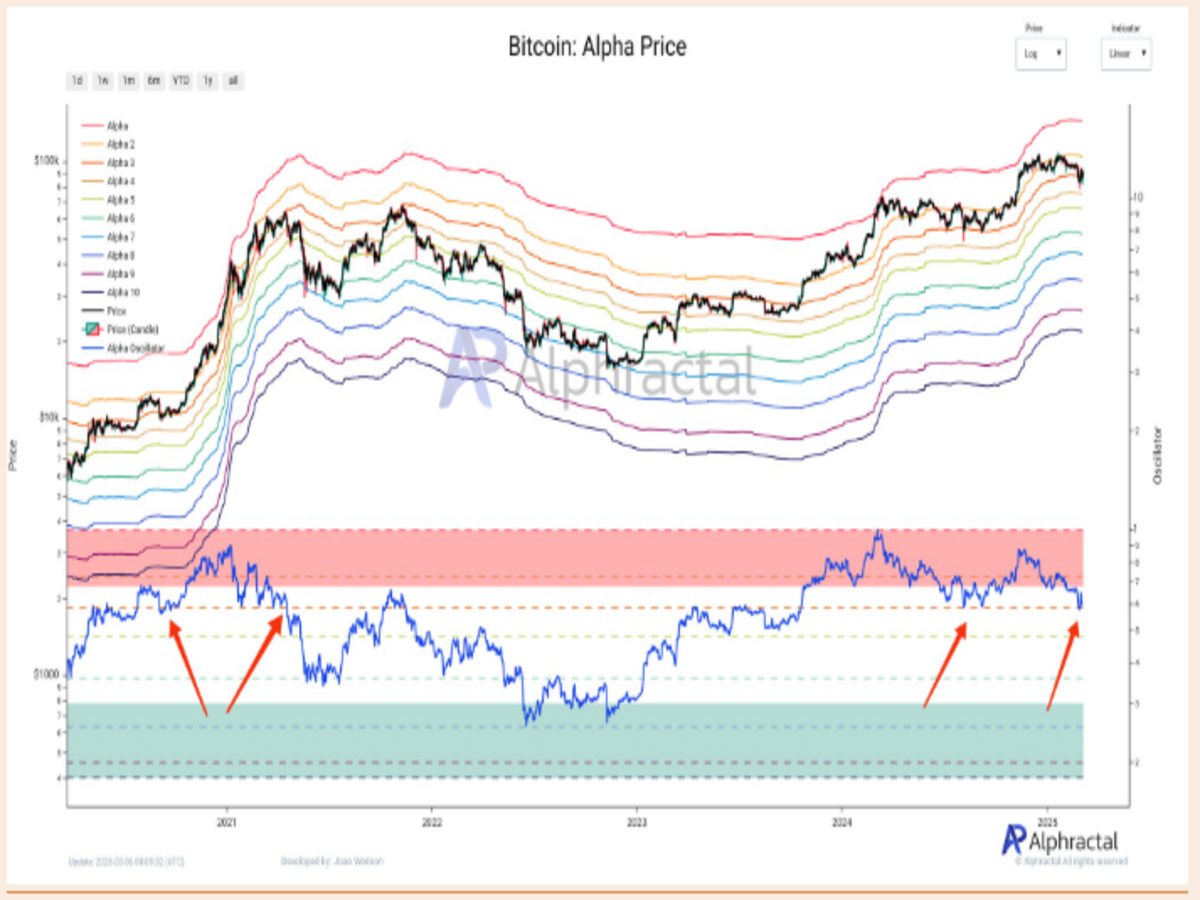

Bitcoin’s Critical Support Level: The Alpha Price Defense

Market participants closely monitor Bitcoin”s price movement from its current position since they need to confirm if it holds important support areas effectively. Market analysts consider the Alpha Price as their last defense point because multiple studies have confirmed it safeguards Bitcoin from major price drops.

The market shows bullish signs since Bitcoin maintained this resistance point before so traders expect more upward momentum. Traders now bring up Bitcoin”s moves from April to May 2021 because its financial assets liquidated in a brief downturn rather than entering an extended loss period.

When Bitcoin stays above its support line it shows industry buyers are forming a position for more growth ahead. If investors push Bitcoin below its present floor the bearish momentum will likely grow with more price drops.

The upcoming weeks will confirm if Bitcoin keeps its support levels to start a new growth phase or experience prolonged market declines. The cryptocurrency market will take a decisive turn based on how much Bitcoin”s major investors and traders invest or sell next.