Bitcoin Accumulation Signals Potential Market Reversal Ahead

Bitcoin holders show strong buying behavior during this market correction just like they did at previous bottom points. The growing trend of Bitcoin held between 3 and 6 months points to a temporary market decline rather than a long-term bear market.

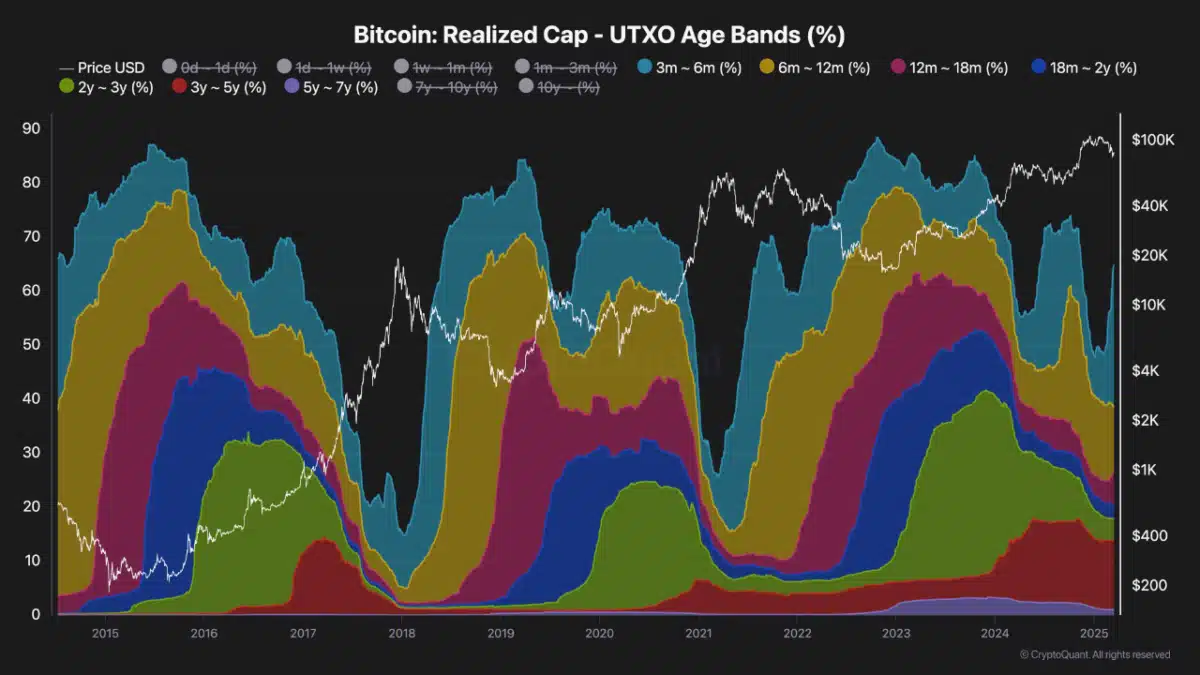

Recent statistics show Bitcoin investors are storing increasingly more of their currency within the comfortable 3-to-6-month UTXO range.

During past market bottoms this group of investors who bought Bitcoin in the last 3 to 6 months has displayed a historical trend of keeping their assets steady. The data shows more 3-6 month Bitcoin holders during two market cycles when the bear periods finished and new growth started in mid-2021 and following the 2022 dip.

The Impact of Bitcoin HODLing on Supply and Demand

The growing belief in Bitcoin is clear through the rising practice of holding onto the volatile digital currency or HODLing. People who bought Bitcoin during its peak and steady periods stay optimistic about its future while thinking this recent price decrease will not lead to an extended market decline.

As different from typical short-term traders and speculators the 3-6 month holders exist to accumulate assets strategically. They now make buying decisions based on their positive future vision instead of panicked selling impulses.

Bitcoin supports stronger price floors when this growing group of investors withstands market instability and refuses to sell. The rising number of Bitcoins being stored in the mid-term window proves that holders are strong and affects both supply-demand patterns for Bitcoin.

Holders of Bitcoin choose to retain their assets to decrease Bitcoin”s circulating amount among investors. When supply drops alongside stable demand the market value may climb upward again after price declines end.

The Shift from Short-Term to Long-Term Bitcoin Holding

The majority of holders who transition from 3-6 month periods to long-term holders typically lose their concern about price movements during this process. This change decreases the amount of Bitcoin sold during market falls and helps keep Bitcoin”s market value steady.

Throughout Bitcoin price cycles major investors have repeatedly added to their holdings during market downturns. As buyer demand returns many accumulated Bitcoins enter the market creating powerful price increases that signal new bull markets. The usual process of buying and hoarding before prices go up repeats itself in this market cycle.

New Bitcoin holders demanding the currency since May show that the market has entered an early buying cycle that can lead to future growth. These holders now show strong commitment because they believe Bitcoin will do well in the future. Market recovery will probably trigger a new price rally when market stability returns.